has capital gains tax increase in 2021

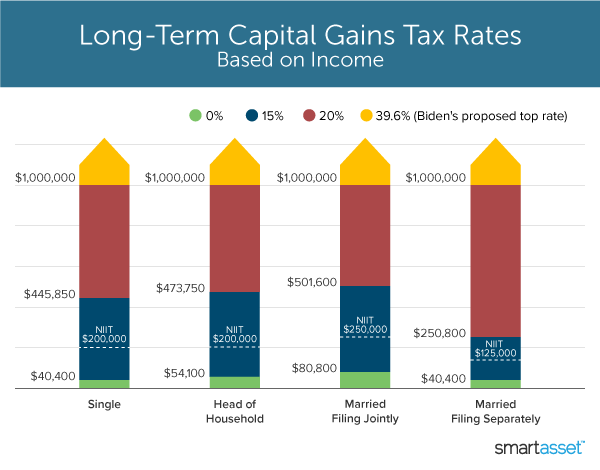

That rate hike amounts to. Long-term Capital Gains Tax Rates for 2022.

What You Need To Know About Capital Gains Tax

The GOP remains resolute against.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

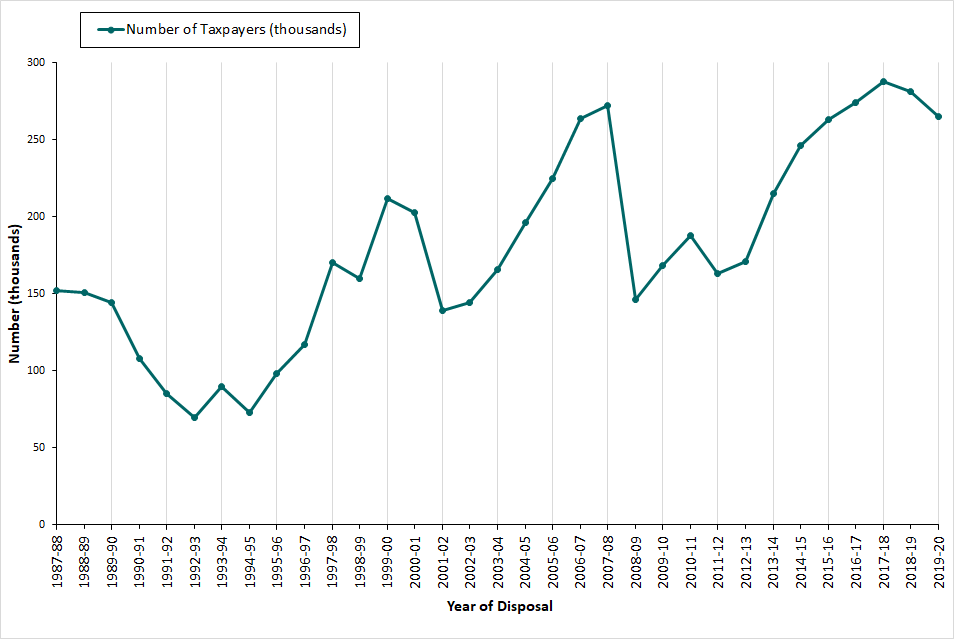

. This tax change is targeted to fund a 18 trillion American Families Plan. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. The current capital gain tax rate for wealthy investors is 20.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Since the early 1950s the long-term capital gains rate has been lower than the top ordinary income tax rate. When the additional tax.

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15. Thats currently 37 but the president is also expected to call for an increase in the top rate for ordinary income to 396. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

Short-term gains are taxed as ordinary income. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. In 2021 the 0 bracket for the capital gains tax was 83350.

Your 2021 Tax Bracket to See Whats Been Adjusted. Up to 53600. Implications for business owners.

The State has appealed the ruling to the Washington Supreme Court. Elsasser also emphasized that ordinary income can increase a retirees capital gains tax rate. Long-Term Capital Gains Tax Rates 2021.

AP A judge has overturned a new capital gains. Liz Claman of Fox Business Listener Housing Questions - 330 Hour 2 Podcast Episode 2021 cast and crew credits including actors actresses directors writers and more. Long-term capital gainstaxes are assessed if you sell investments.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Short-term gains are taxed as ordinary income. Discover Helpful Information and Resources on Taxes From AARP.

The top rate would be 288. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Based on filing status and taxable income long-term capital gains for tax years 2021 and 2022 will be taxed at 0 15 and 20. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. 2020 capital gains tax thresholds for head of household filers.

The 2021 tax brackets. This is called entrepreneurs relief. Capital gains tax rates on most assets held for a year or less correspond to.

Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The proposed capital gains tax reforms of which any Budget.

Ad Compare Your 2022 Tax Bracket vs. 5096 which was signed by Governor Inslee on May 4 2021. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Hundred dollar bills with the words Tax Hikes getty. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37.

Once fully implemented this would mean an effective federal. Long-term capital gains tax rates for 2022 are as follows. For investors who make 1 million or more who are already taxed a surtax on investment.

Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. Capital Gains Tax Increase. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. The 238 rate may go to 434 for some. Here are 10 things to know.

Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic. In 1997 the top rate was reduced from 28 to 20. Add the standard deduction and a.

The Chancellor will announce the next Budget on 3 March 2021. Capital Gains Tax Rates for 2022. That rate hike amounts to a staggering 82 increase in the old rate.

The effective date for this increase would be September 13 2021. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Tds Rate Applicable On Mf Redemptions By Nris For Ay 2021 22 Mutuals Funds Capital Gain Fund

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax Commentary Gov Uk

What S In Biden S Capital Gains Tax Plan Smartasset

How To Pay 0 Capital Gains Taxes With A Six Figure Income

What You Need To Know About Capital Gains Tax

Florida Real Estate Taxes What You Need To Know

Capital Gains Tax Commentary Gov Uk

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)